In the fast-evolving world of technology, AI Agents are emerging as the game-changer in both our daily lives and the crypto ecosystem. Far from being a distant sci‑fi fantasy, these intelligent executors are already automating complex tasks — from managing job applications to executing seamless DeFi operations. As we stand on the brink of a new era in 2025, this article delves deep into the transformative potential of AI agents, exploring their functionality, the different types, and the investment opportunities they present in the blockchain space.

What Are AI Agents?

At their core, AI agents are the executors of artificial intelligence. While traditional AI (like ChatGPT) serves as the "brain" that processes and provides information, AI agents are the "hands" that transform that knowledge into actionable results. Imagine handing over your résumé to a bot that not only scans for the best job openings but also applies to multiple vacancies on your behalf — all automatically. This seamless transformation from thought to action is the essence of AI agents.

The Convergence of AI and Blockchain

The integration of AI agents into the blockchain realm is creating unprecedented opportunities in the crypto market. With the global market cap for AI agent-related tokens hovering around $14 billion, these technologies are still in their infancy relative to giants like Bitcoin or Ethereum. Yet, their potential for growth is enormous.

Consider the scenario where an AI agent handles the entire process of converting Bitcoin to Ethereum and depositing it into your wallet using the most efficient decentralized platforms. This is not merely a hypothetical concept — it's already being developed and refined.

Categories of AI Agents in Crypto

The video script outlines several types of AI agents, each targeting a different niche within the crypto ecosystem:

- Infrastructure Agents

These projects provide the backbone for AI operations on blockchain platforms. Examples include frameworks and launchpads like Virtuals Protocol, which enables users to create and launch their own AI agents. - Influencer Agents

Designed to engage with communities, these agents (e.g., the crypto influencer ixbt) manage social media accounts, provide financial advice, and generate market buzz. While they can drive short-term speculative gains, caution is advised as many of these tokens may lose value over the long term. - Investment DAOs

These are AI-managed funds that automate investment decisions by analyzing market sentiment and executing trades based on real-time data. They promise to streamline portfolio management by reducing human error. - Utility Agents

Focused on automating practical tasks, these agents can execute functions ranging from trading and staking to complex operations in DeFi ecosystems. Their utility lies in the fact that while the underlying product may be sound, the token value is often driven by market sentiment rather than intrinsic functionality.

Tip for Readers: When evaluating these tokens, always perform in-depth research into tokenomics, utility, and market cap comparisons to distinguish between sustainable projects and speculative bubbles.

Tools and Resources for the AI Agent Ecosystem

For those eager to dive deeper into this revolution, several platforms offer invaluable insights and data:

- AI Agents Directory — A comprehensive landscape of current AI agents.

- Cookie.fun — Track the latest developments and market cap data.

- AI Agent Toolkit — Tools and resources to build and deploy your own AI agents.

- CryptoHunt MemeSearch — Explore trends and narratives in crypto.

- Elizas World — Discover the open-source framework behind many AI agent innovations.

How AI Agents Operate in DeFi: A Step-by-Step Flow

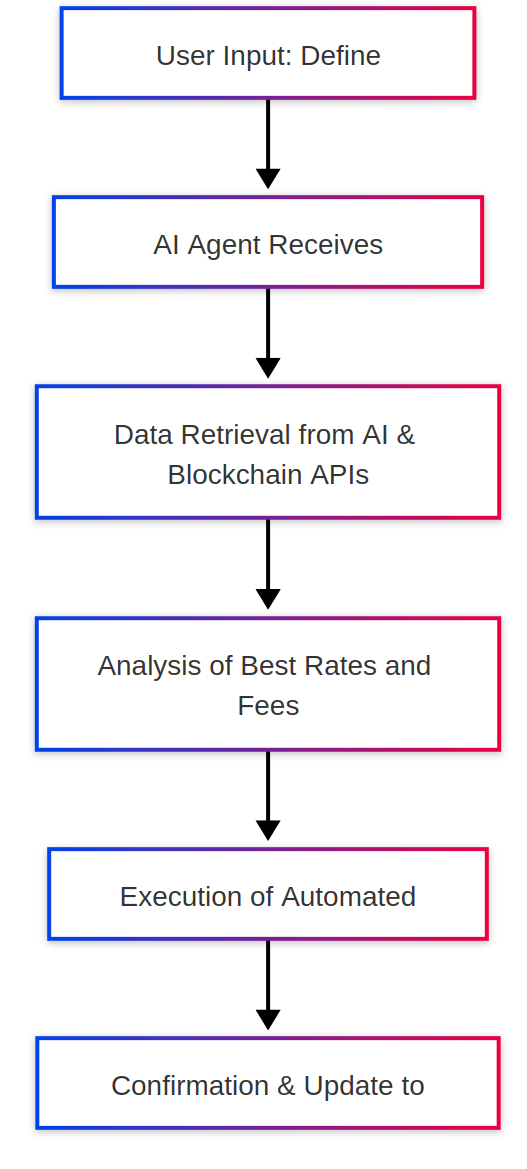

To demystify the process, consider the following flowchart that outlines how an AI agent can automate a DeFi transaction:

This simple diagram illustrates the process — from receiving the initial command to executing the transaction — highlighting the efficiency and precision of AI-driven automation.

Investment Insights and Future Outlook

While the promise of AI agents is undeniable, the landscape is complex and filled with both opportunities and risks. The video emphasizes a speculative approach in the early days:

- Short-Term Speculation: Tokens linked to influencer agents might soar due to market hype but could crash once the novelty fades.

- Long-Term Sustainability: Infrastructure projects and utility agents are likely to yield more reliable returns as they underpin critical blockchain operations.

The key takeaway is to adopt a cautious yet proactive approach. Engage in thorough research, consider short-term gains versus long-term viability, and always remain updated with the rapid innovations in this sector.

Conclusion

AI agents are not just an emerging trend — they represent a fundamental shift in how technology, finance, and daily tasks intertwine. As 2025 unfolds, their influence will likely redefine the crypto landscape, driving innovation and investment opportunities to new heights.

Are you ready to explore this brave new world? Which type of AI agent excites you the most — the high-octane influencer bots or the robust, long-term infrastructure projects? Share your thoughts and join the conversation in the comments below!

source: https://raglup.medium.com/unleashing-ai-agents-the-2025-crypto-revolution-you-cant-ignore-ed3b2bbbb5c1?source=rss-f56f44caad34------2